The 2024 tax reference guide provides essential updates on federal and state tax changes, including inflation-adjusted brackets, deductions, and contribution limits. It also covers tax residency rules, filing deadlines, and strategies to optimize your tax planning for the upcoming year.

The 2024 tax changes reflect significant updates to the U.S. tax system, primarily driven by inflation adjustments and evolving tax policies. For the tax year 2024, individuals and businesses can expect revised tax brackets, modified deductions, and adjusted contribution limits for retirement plans. These changes aim to align tax obligations with the current economic landscape, providing relief to taxpayers impacted by inflation. Key updates include increases in standard deductions, higher income thresholds for tax brackets, and expanded eligibility for certain tax credits. Additionally, the IRS has introduced new guidelines for reporting income, particularly for self-employed individuals and those with international earnings. Taxpayers should also be aware of changes in tax residency rules and international tax implications, which may affect expatriates and cross-border workers. The suspension of certain tax treaties and the introduction of new tax regimes in specific regions further highlight the complexity of the 2024 tax landscape. Staying informed about these updates is crucial for accurate tax filing and effective financial planning. This guide provides a comprehensive overview of the 2024 tax changes, helping taxpayers navigate the complexities and maximize their financial outcomes.

Federal Income Tax Rates and Brackets for 2024

The federal income tax rates for 2024 remain progressive, with seven tax brackets ranging from 10% to 37%. The IRS has adjusted the income thresholds for each bracket to account for inflation, providing relief to taxpayers. Single filers and joint filers will see higher income limits at each tax bracket level compared to the previous year. For example, the 10% bracket now applies to income up to $11,600 for single filers and $23,200 for joint filers. The 12%, 22%, 24%, 32%, and 35% brackets also have increased income thresholds. The top tax rate of 37% applies to income above $609,350 for single filers and $731,200 for joint filers. These adjustments aim to reduce the impact of inflation on taxable income, ensuring that taxpayers are not pushed into higher brackets due to cost-of-living increases. The updated brackets and rates are part of the IRS’s annual effort to align tax obligations with economic conditions. Taxpayers are encouraged to review the new brackets to better plan their financial strategies for the year.

Deductions and Credits for 2024

The 2024 tax year brings several updates to deductions and credits, offering opportunities to reduce taxable income and lower overall tax liability. The standard deduction has increased to $13,850 for single filers and $27,700 for married couples filing jointly. The Earned Income Tax Credit (EITC) has also been expanded, with eligibility adjustments and higher credit amounts for certain filers, particularly workers without qualifying children. Additionally, the Child Tax Credit remains at $3,000 per child under age 17, with up to $1,500 refundable. The Dependent Care Credit has been enhanced, allowing up to $8,000 in eligible expenses for one child and $16,000 for two or more. Students can deduct up to $2,500 in interest on qualified education loans, while the Saver’s Credit provides incentives for low-income individuals contributing to retirement accounts. The Adoption Credit has also been increased, with a maximum of $15,950 in adoption-related expenses eligible for the credit. These changes aim to provide relief and support for families, students, and low-income taxpayers. Proper documentation and eligibility requirements apply to each deduction and credit, so taxpayers are encouraged to review the specific guidelines to maximize their benefits.

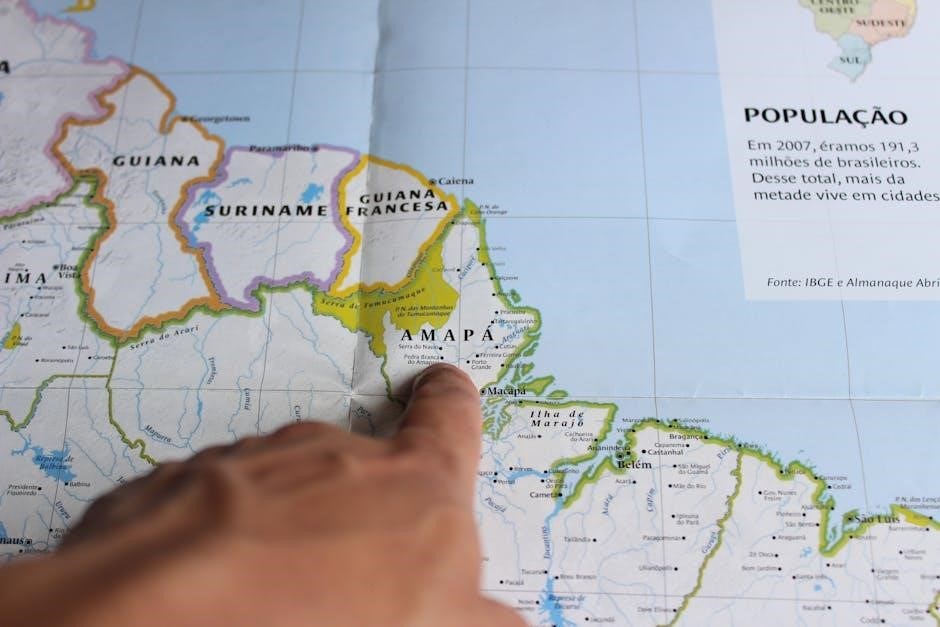

Retirement contribution limits for 2024 have been adjusted to reflect inflation, offering increased opportunities to save for the future. The annual contribution limit for 401(k), 403(b), and 457 plans has risen to $22,500, with an additional $7,500 catch-up contribution allowed for those aged 50 or older. IRA contributions remain at $6,500, with a $1,000 catch-up contribution available for individuals 50 and above. Roth IRA eligibility has been adjusted, with income phase-outs starting at higher thresholds, allowing more individuals to contribute. Additionally, the maximum salary deferral for SIMPLE IRAs has increased to $15,500, with a $3,500 catch-up option. These changes aim to encourage retirement savings across various income levels. Proper planning and understanding of contribution limits can help individuals optimize their retirement savings strategies. As always, consulting with a financial advisor is recommended to ensure compliance with IRS regulations and to maximize retirement benefits. Understanding tax residency and international tax implications is crucial for individuals and businesses with cross-border activities. Tax residency determines which country has the right to tax an individual’s income. In 2024, the IRS reminds taxpayers to report all earned income, including from international sources. The U.S. uses a complex set of rules, including the physical presence test and the substantial presence test, to determine tax residency. Additionally, the suspension of certain tax treaties may impact withholding taxes and other international tax obligations. The PKF Worldwide Tax Guide highlights that tax residency rules vary significantly across the 157 territories it covers. For instance, Spain has introduced new regulations on blockchain and cryptocurrency taxes, affecting international transactions. Meanwhile, the UAE’s Corporate Tax Guide emphasizes updates for Free Zone Persons, which could influence cross-border business operations. Individuals and businesses must navigate these complexities to ensure compliance with both domestic and international tax laws. Consulting with tax professionals is essential to manage risks and optimize tax outcomes in an increasingly interconnected global economy. The 2024 tax filing season brings important updates to deadlines and requirements. The IRS reminds taxpayers that individual tax returns for the 2024 tax year are due by April 15, 2025. However, the Central Board of Direct Taxes (CBDT) has extended the filing deadline for certain cases to July 31, 2025. Taxpayers must ensure they meet these deadlines to avoid penalties and interest. Key requirements include reporting all earned income, including income from international sources. The IRS emphasizes compliance with filing obligations, particularly for self-employment taxes and household employment taxes. For 2024, taxpayers will use Form 1040 or, if eligible, Form 1040-SR. The IRS provides detailed instructions and resources, such as Publication 17, to guide taxpayers through the filing process. Additionally, the UAE’s Corporate Tax Guide and the PKF Worldwide Tax Guide highlight international filing implications, especially for Free Zone Persons and cross-border activities. Taxpayers are encouraged to consult these resources to navigate complex filing requirements. Missing deadlines or failing to report income accurately can result in fines, making it essential to file on time and seek professional advice if needed.

Effective tax planning in 2024 involves maximizing deductions and credits while considering new regulations. One key strategy is to optimize retirement contributions, as limits have increased for plans like 401(k)s and IRAs. Contributions to these accounts can reduce taxable income and provide long-term financial benefits. Another approach is to leverage tax credits, such as those for education expenses or home renovations. For instance, the 50% furniture bonus for renovation work offers significant savings. Additionally, students under 24 may receive tax benefits without filing a return, highlighting the importance of understanding eligibility criteria. Taxpayers should also consider the Net Investment Income Tax, which applies to certain investment earnings. Planning to minimize this tax, such as timing asset sales or adjusting income thresholds, can yield substantial savings. International taxpayers must navigate residency rules and cross-border implications, as outlined in guides like the PKF Worldwide Tax Guide. Consulting with tax professionals can help individuals and businesses implement these strategies effectively, ensuring compliance and maximizing financial outcomes. Proactive planning is crucial to avoid missing deadlines and to capitalize on available tax benefits. In 2024, several states and local governments have introduced changes to their tax systems, impacting residents and businesses. These updates include adjustments to state income tax rates, sales tax modifications, and new deductions or credits. For instance, some states have increased their standard deductions to align with federal inflation adjustments, offering relief to taxpayers. Additionally, certain jurisdictions have expanded tax credits for specific industries or initiatives, such as renewable energy projects or small business development. Local tax authorities have also emphasized compliance with updated filing requirements, including tighter deadlines and enhanced reporting standards. Taxpayers are encouraged to review their state-specific guidelines, as penalties for non-compliance may have increased. International residents and businesses should also be aware of state-level tax residency rules, as these can significantly impact liability. Consulting local tax professionals or referring to official state resources, such as the KPMG State and Local Tax Guide, can help navigate these changes effectively. Staying informed about these updates is crucial for optimizing tax outcomes and ensuring adherence to evolving regulations.Retirement Contribution Limits for 2024

Tax Residency and International Tax Implications

Filing Requirements and Deadlines

Tax Planning Strategies for 2024

State and Local Tax Updates